Sep

16

2020

In the Budget Memorandum the government presented its plans for 2021. We have listed the most important changes for you.

In the Budget Memorandum the government presented its plans for 2021. We have listed the most important changes for you.

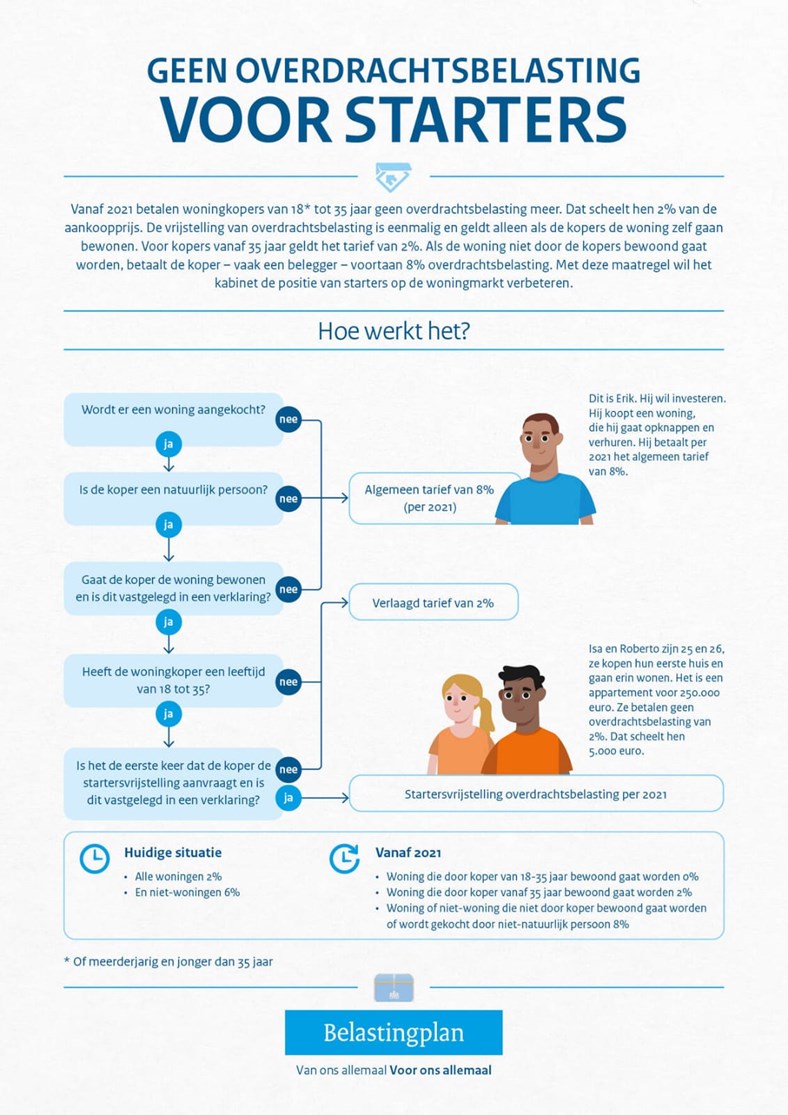

The transfer tax on real estate will be differentiated. First-time buyers are exempted from transfer tax and those selling their property and buying a new home continue to pay 2%. A rate of 8% will apply to all other categories.

The capital gains tax in box 3 will be adjusted to reduce the tax burden on smaller assets in box 3 as of 2021. In addition, the tax rate in Box 3 will be increased to 31%.

The government is in talks with landlord organisations – including Vastgoed Belang – to prevent evictions due to rent arrears as much as possible.

The government is focusing on more and faster housing development and making the built environment more sustainable through additional investments.

Tenants with a low income paying a high rent (in relation to their income) for a rental property through a housing association are entitled to a one-off rent reduction.

In order to finance the compulsory rent reduction by housing associations for low-income tenants, the government is reducing the rate of the landlord tax as of 1 January 2021 from 0.562% in 2020 to 0.526% in 2021.

In the case of substantial interest holders who borrow more than €500,000 from their company, it is proposed to tax the excess as of 1 January 2023 as income from a substantial interest.

Source: Vastgoedbelang

December

6

2022

The aim of the portal is to provide the homeowner with information online about their property

April

20

2020

The Land Registry, the public register of all real estate, states that Covid-19 has not yet had a major impact on the housing market.

March

9

2020

We joined VBO at the beginning of March 2020. That's worth celebrating!